Marcellus Shale lease per acre 2022 is a topic of great interest in the energy industry. The Marcellus Shale is a major natural gas formation located in the Appalachian Basin, and it has been a major source of natural gas production in recent years.

As a result, there has been a lot of interest in leasing land in the Marcellus Shale for natural gas development.

In this article, we will discuss the current state of the Marcellus Shale lease market, including lease prices and acreage leased in recent months. We will also discuss factors influencing lease prices, such as commodity prices, regulatory changes, and industry activity.

Market Overview: Marcellus Shale Lease Per Acre 2022

The Marcellus Shale lease market in 2022 has experienced significant fluctuations driven by various factors. In recent months, lease prices have remained relatively stable, ranging from $1,000 to $3,000 per acre. However, acreage leased has declined compared to previous years, indicating a cautious approach from oil and gas companies.

Key factors influencing lease prices include commodity prices, regulatory changes, and industry activity. The recent decline in natural gas prices has put downward pressure on lease prices, while the Biden administration’s focus on renewable energy has created uncertainty in the long-term outlook for fossil fuels.

Regional Variations

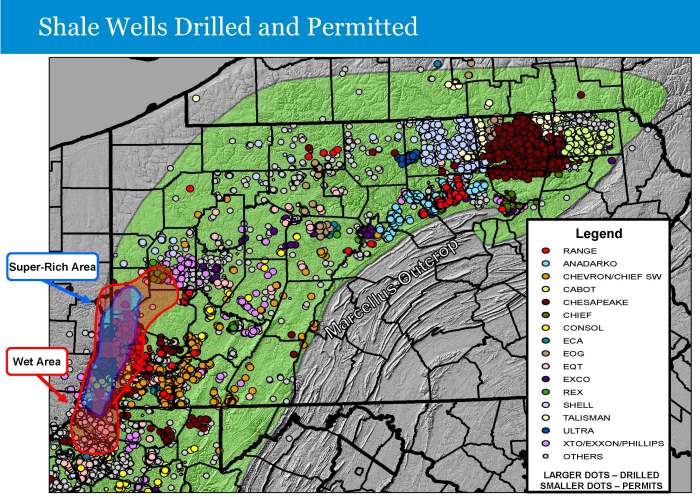

Within the Marcellus Shale, lease prices vary significantly across different regions. The highest prices are typically found in the southwestern part of Pennsylvania, where the geology is favorable for gas production and there is close proximity to major markets. In contrast, lease prices in West Virginia and New York tend to be lower due to less favorable geology and greater distance from markets.

Other factors contributing to regional variations include infrastructure development and the presence of competing land uses. Areas with well-developed infrastructure, such as pipelines and processing facilities, attract higher lease prices. Additionally, regions with competing land uses, such as agriculture or conservation areas, may have lower lease prices due to limited availability of land for gas development.

Lease Terms and Negotiations

Common lease terms in the Marcellus Shale include a lease duration of 5-10 years, royalty rates ranging from 12.5% to 18.75%, and bonus payments of $1,000-$5,000 per acre. Negotiations between landowners and oil and gas companies typically focus on these terms, as well as provisions related to environmental protection and surface rights.

Landowners often seek higher royalty rates and bonus payments, while oil and gas companies aim to minimize their costs and secure favorable drilling rights. Successful lease negotiations require careful consideration of these interests and a willingness to compromise.

Environmental Considerations

Marcellus Shale development has raised concerns about its environmental impact on air, water, and land. Air pollution from drilling and production activities can contribute to ozone formation and respiratory problems. Water pollution can occur from spills, leaks, and wastewater discharge.

Land use changes associated with development can fragment habitats and degrade ecosystems.

To mitigate these risks, regulations have been implemented to require best practices for drilling and production. These regulations include measures to reduce air emissions, protect water resources, and minimize land disturbance. Additionally, landowners and oil and gas companies can implement voluntary measures, such as using low-impact drilling techniques and restoring disturbed land, to further reduce environmental impacts.

Future Outlook, Marcellus shale lease per acre 2022

The future of the Marcellus Shale lease market depends on several factors, including the long-term demand for natural gas, government policies, and technological advancements. If natural gas demand remains strong and regulations are supportive, lease prices and activity are likely to remain stable or increase.

However, if demand for natural gas declines or regulations become more stringent, lease prices and activity could decline. Technological advancements, such as improved drilling techniques and reduced production costs, could also impact the future of the lease market.

For landowners, it is important to consider the long-term implications of leasing their land for gas development. While leasing can provide financial benefits, it is crucial to understand the potential environmental risks and negotiate lease terms that protect their interests.

FAQ Resource

What is the average lease price per acre in the Marcellus Shale?

The average lease price per acre in the Marcellus Shale varies depending on the location and other factors. However, recent lease prices have been in the range of $5,000 to $10,000 per acre.

What are the factors that influence lease prices in the Marcellus Shale?

The factors that influence lease prices in the Marcellus Shale include commodity prices, regulatory changes, and industry activity.

How can landowners negotiate favorable lease terms?

Landowners can negotiate favorable lease terms by understanding the factors that influence lease prices and by working with an experienced attorney.